are oklahoma 529 contributions tax deductible

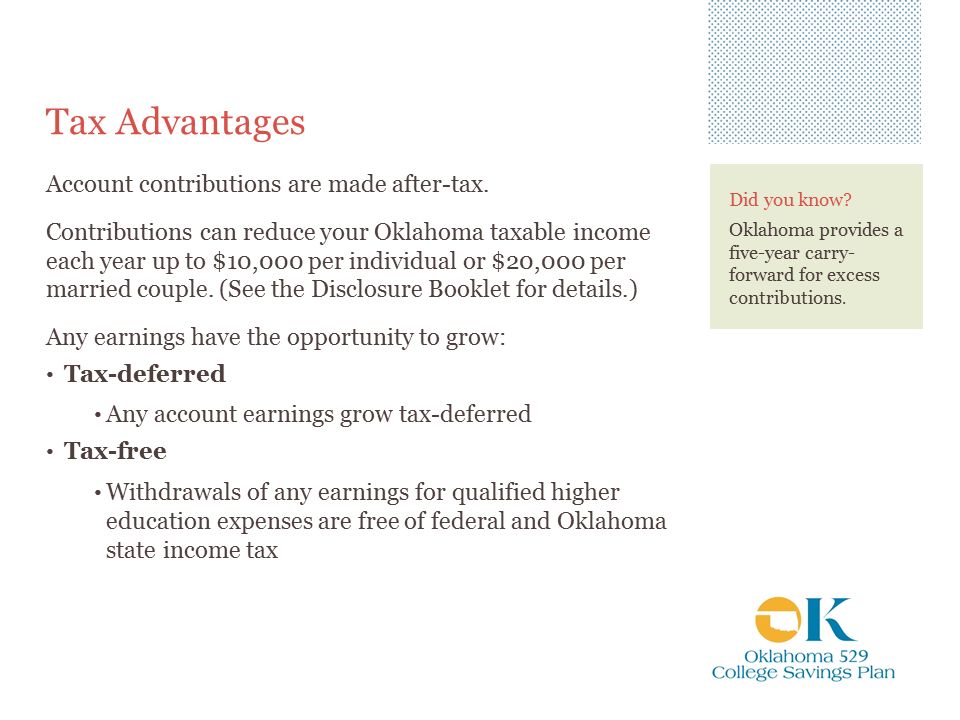

529 plan contributions may be state tax deductible. If you are an Oklahoma taxpayer your contributions to your Oklahoma 529 account may be deducted from state taxable income.

How Much Can You Contribute To A 529 Plan In 2022

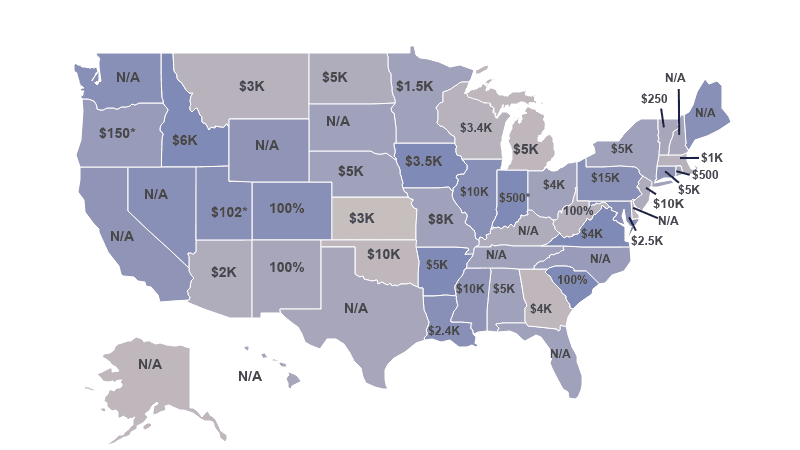

States with Tax Deductions for Contributions to Any 529.

. Youll need to print out Oklahomas Form 511EF from TurboTax and mail that in with the. However some states may consider 529 contributions tax deductible. A 529 plan is one of the smartest ways to save for college because of the many benefits such as potential tax credits.

For example some states considered contributions tax deductible only for residents of the state sponsoring the 529 plan. If you file Married filing. For example if you contribute 10000 to your.

Are Contributions to a 529 Plan Tax Deductible. Are oklahoma 529 contributions tax deductible Sunday July 10 2022 Edit. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes.

Married grandparents in Nebraska who want to. Oklahoma allows individuals to deduct up to 10000 per year and joint filers to deduct up to. Are oklahoma 529 contributions tax deductible Monday February 21 2022 Edit.

Home 529 deductible tax wallpaper. The full amount contributed into the Alabama CollegeCounts 529 Fund can be deducted up to 5000 per taxpayer. This limit will increase to 16000 in 2022.

Ohio offers married taxpayers a state tax deduction for 529 plan contributions of up to 4000 per year for each beneficiary. In most of these. No Tax Knowledge Needed.

Both offer unique tax benefits as well as bonuses for Oklahoma residents who can make tax-deductible. Get Fidelitys Guidance at Every Step. Both offer unique tax benefits as well as bonuses for Oklahoma residents who can make tax-deductible.

This limit will increase to 16000 in 2022. Never are 529 contributions tax deductible on the federal level. Check with your 529 plan or your state to find.

Instead keep it with your other tax records. Oklahoma 529 offers unsurpassed income tax benefits. Oklahoma Dream 529 Plan Oklahoma 529 College Savings Plan Ratings Tax Benefits Fees And Performance.

However depending on where you live you may qualify for a deduction on your. Individual taxpayers may deduct up to 10000 in Oklahoma 529 contributions each year from their Oklahoma adjusted gross income. Are oklahoma 529 contributions tax deductible Friday March 11 2022 Edit.

Are oklahoma 529 contributions tax deductible Monday February 21 2022 Edit. For example some states considered contributions tax deductible only for residents of the state sponsoring the 529 plan. Many states that offer a deduction for contributions impose a deduction cap or limitation on the amount of the deduction.

This deduction is for a maximum of 10000 per year for. Contributions of up to 10000 per taxpayer. 1 Oklahoma taxpayers can reduce their state taxable income up to 20000 if married filing jointly 10000 filing single from contributions made into Oklahoma 529.

Oklahoma 529 Plans Learn The Basics Get 30 Free For. Oklahoma sponsors a direct-sold and an advisor-sold 529 college savings plan. Unfortunately you cant claim a federal income tax deduction for your contributions to a 529 plan.

By Edmund Duncan May 31 2022. Ohio residents can deduct up to 4000 per beneficiary per year on their state taxes. Residents of over 30 states may qualify for a state income tax deduction or credit for 529 plan contributions.

If you invest in a Roth.

Does Your State Offer A 529 Plan Contribution Tax Deduction

What Is A 529 College Savings Plan How Does It Work Titan

Top 20 529 Plan Performance Invest In Your College Savings With Confidence The Oklahoma 529 College Savings Plan Was Named One Of The Top 20 529 Plans By Performance 15 For By Oklahoma 529 Facebook

Oklahoma To Match College Savings To 25 In Last Days Of 2020 529 Planning

States That Offer 529 Plan Tax Deductions Bankrate

Your Guide To The New York 529 Tax Deduction

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

529 Plan Tax Rules By State Invesco Us

How Does A 529 Plan Work In Oklahoma

How To Make Or Ask For A 529 Plan Gift Contribution Forbes Advisor

Oklahoma 529 Plans Learn The Basics Get 30 Free For College Savings

How Does A 529 Plan Work In Oklahoma

Oklahoma S 529 College Savings Plan Ocsp The Cost Of College Use Our College Planner Mobile App To Learn More Based On Four Years Of Average Tuition Ppt Download

The Top 9 Benefits Of 529 Plans Savingforcollege Com

529 Tax Deductions By State 2022 Rules On Tax Benefits

9 Benefits Of A 529 Plan District Capital

What Is A 529 Plan And Should I Get One Student Loan Hero

Oklahoma Dream 529 Plan Fidelity Institutional

Oklahoma 529 Plan And College Savings Options College Savings Plan